Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

The people of my age popularly known as “YOUTH OF THE COUNTRY” have to pass out from the safe portals of institutions and colleges one day and land directly to a not-so-safe place ;generally known as “REALITY” . They have to face the challenge of managing some or the other key aspect of our economy, be it agriculture, industry or services.

All the sectors are alligned with the flow and availability of funds in the economy which is directly related to – THE MONETARY POLICY of the country. Monetary policy is the policy adopted by the monetary authority of a country that controls either the interest rate payable on very short-term borrowing or the money supply, often targeting inflation or the interest rate to ensure price stability and general trust in the currency.A tool which manages liquidity in the economy is repo & reverse repo rate . RESERVE BANK OF INDIA is the sole manager of the repo and reverse repo rate in India. Essentially, RBI manages day-to-day functioning of monetary policy in pursuit of ultimate objective of price stability and growth. Now question pops up in mind that how they actually do this management ie. the operating framework and is this framework effective enough to manage the cash flows in a economy as big as Indian economy ?

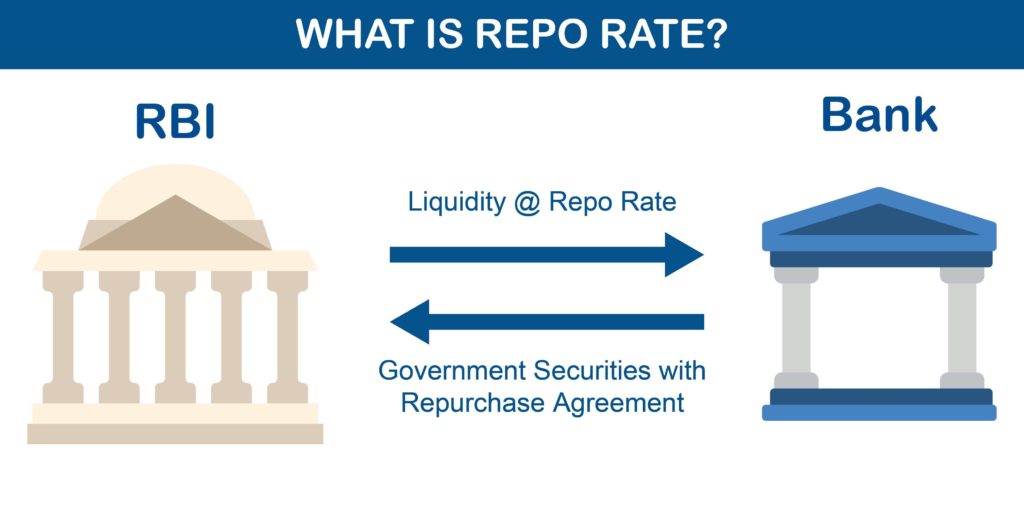

let’s answer these questions one by one, firstly we need to understand what REPO means . Repo means repurchase agreement ;Under this system a bank can borrow money from RBI with the intention of paying back that money at a future date with interest. On the other hand reverse repo means the rate at which RBI borrows back from commercial banks . Easy enough to understand the meaning of these terms, right? but now let’s understand what effect they actually do when it comes to liquidity management -A high repo rate helps drain excess liquidity from the market, whereas a high reverse repo rate helps inject liquidity into the economic system. The repo rate is always higher than the reverse repo rate. Repo rate is used to control inflation and reverse repo rate is used to control the money supply.

The above picture is the best explanation of repo & reverse rate .

The two rates act as the ceiling and floor of an interest rate corridor around the rate at which inter-bank dealings take place.

THAT’S ALL FOR TODAY FOLKS !! 🙂

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.